Home security ‘s the difference in the value of your own land plus the matter your debt with it. When you yourself have sufficient homes security, it can be utilized because collateral to borrow funds a variety of purposes, like to purchase a property, carrying out a business, or settling debts. not, playing with land because the collateral likewise has specific threats and you will downsides that you should know out-of before deciding. Within part, we are going to discuss the pros and cons of using property given that guarantee off other viewpoints, such as for example lenders, individuals, and you may environmentalists.

1. Land is a valuable and stable asset that can increase your credit capabilities and lower your cost of credit. Lenders are more willing to lend you money if you have land as collateral, because they have a security in case you default on your payments. You can also negotiate top terms and conditions for your loan, such as longer repayment periods, straight down rates of interest, and flexible payment selection.

dos. You can power your advantage instead of attempting to sell they. For many who own cash loan Tanacross AK house that you are not using or thought to make use of in the future, it can be used because equity to invest in your own other goals otherwise requires, particularly purchasing a property, investing a business, otherwise buying degree. There is no need to market the house otherwise cure control from it, as long as you pay your loan promptly. You can benefit from any really love about property value their residential property throughout the years.

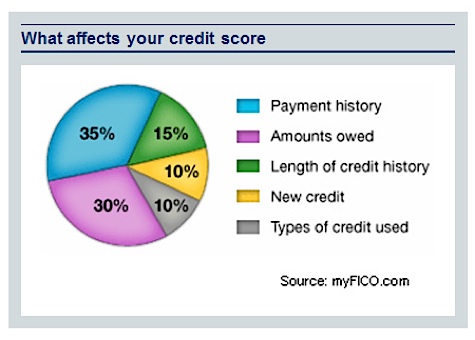

By simply making timely and you can consistent money, you could potentially demonstrated your creditworthiness and reliability in order to lenders, that can alter your credit rating and increase your chances of delivering acknowledged to other fund or handmade cards later

3. You can improve your credit history and you may monetary situation. Using land as collateral can help you improve your credit score and financial situation, if you manage your loan responsibly. You can also use the money you borrow to pay the highest-attract debts, such as credit cards or personal loans, and reduce your debt-to-income ratio.

You have access to larger money having straight down interest levels

1. You exposure shedding the belongings if you fail to repay your mortgage. The biggest likelihood of using homes since the collateral is you could lose your own house for many who standard on the mortgage otherwise financial. For folks who miss your payments otherwise get behind on the mortgage loans, the lender comes with the right to foreclose on your own belongings and sell to recover their money. You could potentially eradicate their belongings security, disregard the, and your coming preparations for your residential property. You could also deal with legal consequences, eg lawsuits, liens, otherwise judgments, which will apply to your credit rating and you will financial situation for years.

2. You may also face trouble in finding a suitable lender otherwise mortgage product. Only a few lenders are happy otherwise able to give money or mortgage loans considering house as equity. Certain loan providers may have rigorous criteria or restrictions on the sort of, area, size, or worth of the newest land it accept while the guarantee. Specific loan providers may costs higher fees or rates for land-dependent financing, to pay towards higher risk and lower exchangeability away from property since the a secured asset. You may need to comparison shop and you can examine more lenders and you can mortgage circumstances to discover the best price for your state.

3. You have bad affects towards environment plus the neighborhood. Playing with land as the collateral may have negative influences into the environment and people, especially if you make use of your property getting advancement or construction intentions. Such as for example, you might have to clear trees, plant life, or wildlife habitats and work out your own land more appealing otherwise available so you’re able to lenders or consumers. You can also experience zoning, helping, otherwise environmental laws and regulations that will limitation or restrict your the means to access the property. You can face opposition or opposition from your own locals or your regional society, who has got additional viewpoints otherwise interests regarding your homes.