Under the periodic inventory system, we will debit Transportation (or freight) In for the shipping cost and credit cash or accounts payable depending on if we paid it now or later. There are two systems that we can use to manage the inventory, periodic and perpetual. The periodic inventory system will record the purchase inventory into the purchase account. It is the temporary account that will be reversed to zero on the reporting date. Some companies put it under the inventory sub-account, however, we can put it in any account as it is just a temporary account.

Everything to Run Your Business

- In a perpetual system, the COGS account is current after each sale, even between the traditional accounting periods.

- For many small businesses, this method is a perfect solution and makes a lot of sense.

- Further investigation would take place if the amount of the shortage was significant.

- If there is excess quantity then that may either be wasted or due to time lag, lose its value or benefit.

Now, keep in mind that the previously mentioned advantages only benefit small businesses that deal with a couple of hundred sales a year. Buyers must record shipping charges as transportation in (or Freight In) when the goods were shipped FOB shipping point and they have received title to the merchandise. This lack of information can result in a loss of possible revenue and sales opportunities. For many small businesses, this method is a perfect solution and makes a lot of sense. Therefore, the above are step by step approach to this kind of stock management which should be followed in the company so t make the system more efficient.

Different between Periodic and Perpetual

The specific identification method is the same in both a periodic system and perpetual system. Although not widely used, this method requires an extremely detailed physical inventory. The company must know the total units of each good and what they paid for each item left at the end of the period. In other words, the company attaches the actual cost to each unit of its products. This is simple when the products are large items, such as cars or luxury technology goods, because the company must give each unit a unique identification number or tag.

Perpetual Journal Entries

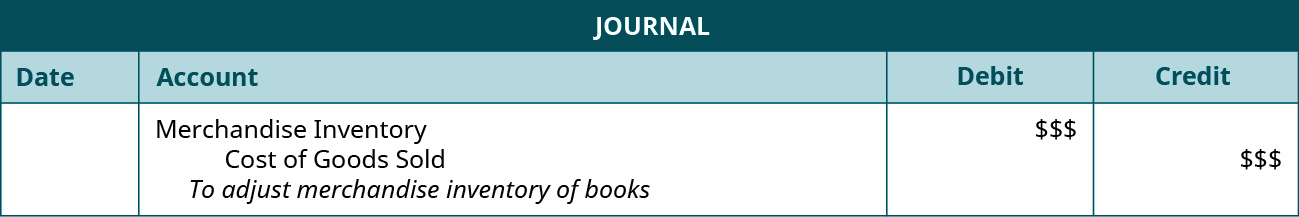

Consequently, there are no merchandise inventory account entries during the period. A simplified form of the above journal entry uses a single debit or credit to inventory account by calculating the difference of ending inventory and beginning inventory. If the difference is positive, the inventory account will be debited for the difference and if it the difference is negative, the journal entry will credit the inventory account by the difference.

We use the same table (inventory card) for this example as in the periodic FIFO example. In a perpetual inventory system, the maintenance of a separate subsidiary ledger showing data about the individual items on hand is essential. On February 28, 2009, Best Buy reported inventory totaling $4.753 billion. what if i didn’t receive a 1099 However, the company also needs specific information as to the quantity, type, and location of all televisions, cameras, computers, and the like that make up this sum. That is the significance of a perpetual system; it provides the ability to keep track of the various types of merchandise.

Purchase Returns and Allowances is a contra account and is used to reduce Purchases. Under the periodic inventory system, when company makes sales, they only record the revenue and accounts receivable/cash. The journal entry is debiting accounts receivable or cash and credit sales revenue. Under a periodic review inventory system, the accounting practices are different than with a perpetual review system. To calculate the amount at the end of the year for periodic inventory, the company performs a physical count of stock.

The adjusting entry is based on the formula to calculate the cost of goods sold. Thus, the purchases and merchandise inventory (beginning) are added together and represent goods available for sale. The periodic vs perpetual inventory journal entries diagram used in this tutorial is available for download in PDF format by following the link below. Our periodic inventory journal entries reference section illustrates further examples of the journals. Record sales discount by debiting the sales discount account and crediting the accounts receivable account. The periodic inventory system is a software system that supports taking a periodic count of stock.

Both returns and allowances reduce the buyer’s debt to the seller (accounts payable) and decrease the cost of the goods purchased (purchases). The buyer may want to know the amount of returns and allowances as the first step in controlling the costs incurred in returning unsatisfactory merchandise or negotiating purchase allowances. For this reason, buyers record purchase returns and allowances in a separate Purchase Returns and Allowances account. The perpetual inventory system gives real-time updates and keeps a constant flow of inventory information available for decision-makers. With advancements in point-of-sale technologies, inventory is updated automatically and transferred into the company’s accounting system. This allows managers to make decisions as it relates to inventory purchases, stocking, and sales.

Once the ending inventory and cost of goods sold are clarified, the accounts require adjustment to reflect the ending inventory balance and the cost of goods sold. Preparing financial statements under the periodic inventory system means calculating the cost of goods sold during the period and the ending inventory. The net sale will be recorded only $ 9,500 due to the discount while the accounts receivable increase only $ 9,500 too. When the company purchase inventory, they have to record purchase and accounts payable. Each of the accounting systems can use one of three main costing methods to determine which inventory has been sold and therefore the cost of the sale and the value of the inventory remaining. Our perpetual inventory system journal entries reference section illustrates further of the examples..

When the company makes sale, they have to record accounts receivable, sales discount, and sale revenue. The journal entry is debiting accounts receivable $ 9,500, sales discount $ 500, and credit sales revenue $ 10,000. In the periodic inventory accounting system, the balance on the inventory account is not changed throughout the accounting period, but remains at its beginning balance until the end of the accounting period. At the end of the accounting period, the inventory is counted and the balance is adjusted to the physical count. The period inventory system is less time consuming to maintain but does not provide details of the inventory and costs of sales during the financial period. In contrast, the perpetual inventory system requires details of each inventory movement to be recorded.

Hence, the system is easier to implement, requires little accounting knowledge, and records changes in inventory through very few simple calculations. Through a perpetual system, businesses are also able to access inventory reports at all times, and reduce human error through automation. Thus, the above are some characteristics of periodic inventory system which some companies follow to make their system efficient and transparent.