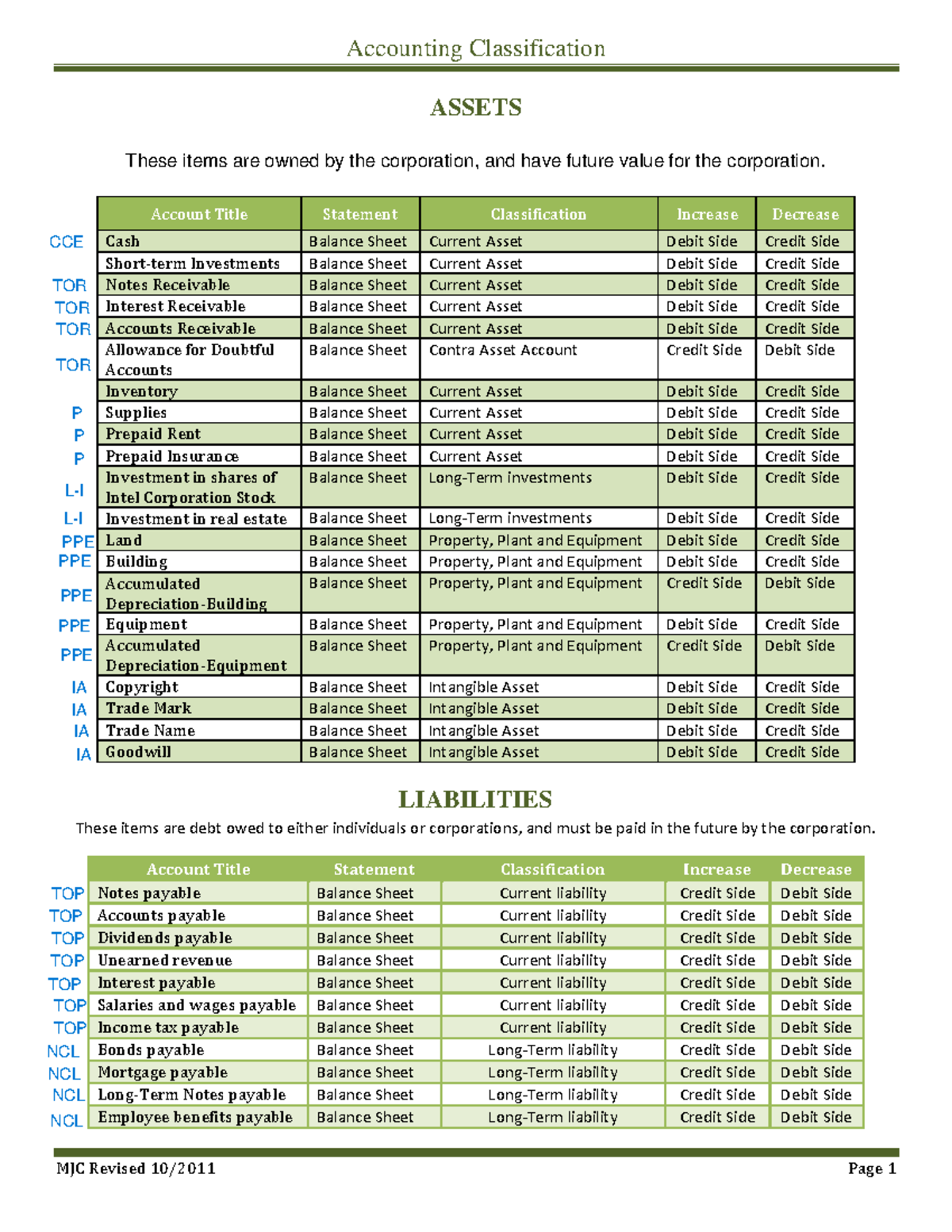

We can define financial accounting as a process of recording, summarizing, and reporting various transactions that occur over a period of time during the course of business. Assets like accounts receivable and inventory are also called control accounts, since they show a balance, with transactions, that is backed-up by a subsidiary ledger. For example, assume the accounts receivable general ledger account has a balance of $25,000. The figure below illustrates the difference between a general and subsidiary ledger. Again, equity accounts increase through credits and decrease through debits. The accounts used in a company’s accounting system are set out in its chart of accounts, which provides more details than the financial statements.

What is the chart of accounts in accounting?

The simplest way to record transactions is to write them into an accounting journal, adjusting different account classifications accordingly. If, say, a customer who owes you $500 pays the bill, that affects two classes, accounts receivable (now $500 smaller) and cash ($500 larger). Entering every single transaction as it happens takes time and increases the possibility of mistakes. With accounting software, bookkeepers can simply record in the software when the company receives a vendor invoice or paychecks go out. The software then automatically debits or credits the appropriate account classifications.

Control Accounts and Subsidiary Ledgers

Examples of personal accounts include John’s account, Peter’s account, Procter and Gamble’s account, Vibrant Marketing Agency’s account and City bank’s account etc. The business keeps a separate account for each individual and organization for the purpose of ascertaining the balance due from or due to them. In accounting, the accounts are classified using one of two approaches – modern approach or traditional approach. We shall describe modern approach first because this approach of classification of accounts is used in almost every advanced country. The use of traditional approach is very limited and it will be discussed later. Remember that debits increase your expenses, and credits decrease expense accounts.

What are the 3 types of traditional approaches?

- By this point, you might be wondering about all the other accounts you’ve seen and heard of.

- The bank account is a real account but not a personal or nominal one.

- Your company’s Equity accounts will increase when there is an investment or funding into your business and decrease when there is a loss or an owner’s draw occurs.

- Normally, nominal accounts are used to accumulate income and expense data.

- Personal accounts created by law are called artificial personal accounts.

However, the main ledgers are the general ledger, the sales ledger, and the purchase ledger. For example, there could be one account called Travel Expenses, but with sub-accounts like Travel Meals and Flight to track the travel expenses in more detailed categories. You can easily report on the most applicable sub-account to get a sense of the financials in that category. This is a much faster method than scrolling through numerous transactions in the Travel Expenses account, trying to distinguish which are meals and which are flights. Simply put, each account type mentioned usually includes certain major accounts, for example, Bank Accounts and Accounts Receivables are commonly used accounts that belong to the Assets Account Type.

Expense accounts:

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Sort and track transactions using accounts to create financial statements and make business decisions. The document-based data that comes under financial accounting are income bills, statements, and balance sheets. The executives can derive reports related to company transactions from financial accounting.

Classification of accounts in the ledgers helps the accounting department create the financial statements. If the sale and purchase of assets have been properly recorded, that makes it easier to see the asset classifications you need to report on the balance sheet. Businesses that record only cash transactions don’t need a cash flow statement.

Besides these, any revenue received in advance is also a liability of the business and is known as unearned revenue. For example, a marketing firm may receive marketing fee from its client for the forthcoming quarter in advance. Such unearned revenue would be recorded as a liability as long as the related marketing services free rental monthly rent invoice template against it are not provided to the client who has made the advance payment. Keeping track of your different types of accounts in accounting can be a challenge. Remember, you can create a chart of accounts to stay organized. The debit and credit rules are applied correctly when the type of account is accurately identified.

And you can trust that it’s more accurate than trying to juggle your transactions across a limited landscape. We should preface this headline by saying businesses can have a seemingly endless number of account types. And while that’s true, all those accounts fall under one of 5 account categories. This makes compiling the other account types easier for systematic review and retrieval. Examples of such accounts include machinery accounts, land accounts, furniture accounts, cash accounts, and accounts payable accounts. To increase revenue accounts, credit the corresponding sub-account.

Check out our accounting category and get updates on the latest trends and insights. (b) MSMEs that are otherwise not exempted from applying this standard [refer note 2(A)(ii)] may not comply with paragraphs 121(c)(ii); 121(d)(i); 121(d)(ii) and 123 relating to disclosures. Consequently, if such MSME chooses to measure the ‘value in use’ by not using the present value technique, the relevant provisions of AS 28, such as discount rate etc., would not be applicable to such an entity. Further, such an entity neednot disclose the information required by paragraph 121(g) of the Standard.

It helps management to determine the cost involved in manufacturing a product or services by use of different cost accounting method. Accrual method entails recording transaction as and when the transaction occurs and revenue is recognizable or expenses are certain and payable. In the case of the cash method, we record transactions on the basis of the exchange of cash. Some people get confused when they see Accounts Receivable since they don’t physically have that money on hand. But because that money is still owed to you, it counts toward your assets. Remember, under the Assets category, credits decrease while debits increase.