The current ratio is a very common financial ratio to measure liquidity. On the other hand, a current ratio greater than one can also be a sign that the company has too much unsold inventory or cash on hand. Though they may appear to have the same level of risk, analysts would have different expectations for each company depending on how the current ratio of each had changed over time.

Everything You Need To Master Financial Modeling

- However, it is essential to note that a trend of increasing current ratios may not always be positive.

- Meanwhile, an improving current ratio could indicate an opportunity to invest in an undervalued stock amid a turnaround.

- A high current ratio, on the other hand, may indicate inefficient use of assets, or a company that’s hanging on to excess cash instead of reinvesting it in growing the business.

For example, the inventory listed on a balance sheet shows how much the company initially paid for that inventory. Since companies usually sell inventory for more than it costs to acquire, that can impact the overall ratio. Additionally, a company may have a low back stock of inventory due to an efficient supply chain and loyal customer base. In that case, the current inventory would show a low value, potentially offsetting the ratio. Another way a company may manipulate its current ratio is by temporarily reducing inventory levels. This will increase the ratio because inventory is considered a current asset.

How does Working Capital relate to liquidity?

Today, we unravel the ‘Current Ratio,’ a key metric used to assess a company’s financial health. Current ratio is equal to total current assets divided by total current liabilities. A high current ratio is generally considered a favorable sign for the company.

Focusing Only On Short-Term Financial Health – Mistakes Companies Make When Analyzing Their Current Ratio

Meanwhile, an improving current ratio could indicate an opportunity to invest in an undervalued stock amid a turnaround. Changes in the current ratio over time can often offer a clearer picture of a company’s finances. A company that seems to have an acceptable current ratio could be trending toward a situation in which it will struggle to pay its bills. Conversely, a company that may appear to be struggling now could be making good progress toward a healthier current ratio. Instead, we should closely observe this ratio over some time – whether the ratio is showing a steady increase or a decrease. Instead, there is a clear pattern of seasonality in current ratio equations.

Why Standard Costing Often Fails in Modern Business Environments

However, the end result of the calculation could mean different things based on the result. Let us understand how to interpret the data from a current ration calculator through the discussion below. These calculations are fairly advanced, and you probably won’t need to perform them for your business, but if you’re curious, you can read more about the current cash debt coverage ratio and the CCC.

Sales Cycle – How Does the Industry in Which a Company Operates Affect Its Current Ratio?

It also offers more insight when calculated repeatedly over several periods. Companies may attempt to manipulate their current ratio to give investors or lenders a clearer picture of their financial health. This is because inventory can be more challenging to convert into cash quickly than other current assets and may be subject to write-downs or obsolescence. For example, hello fans of xero personal a company with a high proportion of short-term debt may have lower liquidity than a company with a high proportion of accounts payable. Seasonality is normally seen in seasonal commodity-related businesses where raw materials like sugar, wheat, etc., are required. Such purchases are done annually, depending on availability, and are consumed throughout the year.

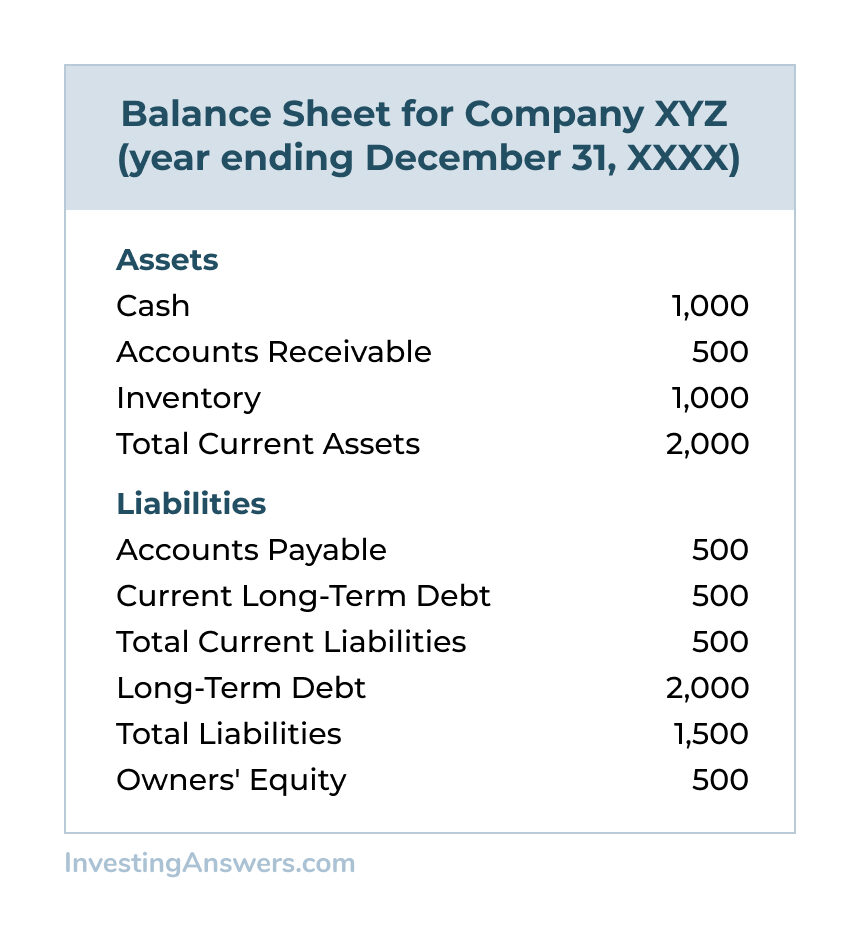

To calculate the current ratio, divide the company’s current assets by its current liabilities. Current assets are those that can be converted into cash within one year, while current liabilities are obligations expected to be paid within one year. Examples of current assets include cash, inventory, and accounts receivable. Examples of current liabilities include accounts payable, wages payable, and the current portion of any scheduled interest or principal payments. Both current assets and current liabilities are listed on a company’s balance sheet.

Ask a question about your financial situation providing as much detail as possible. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.