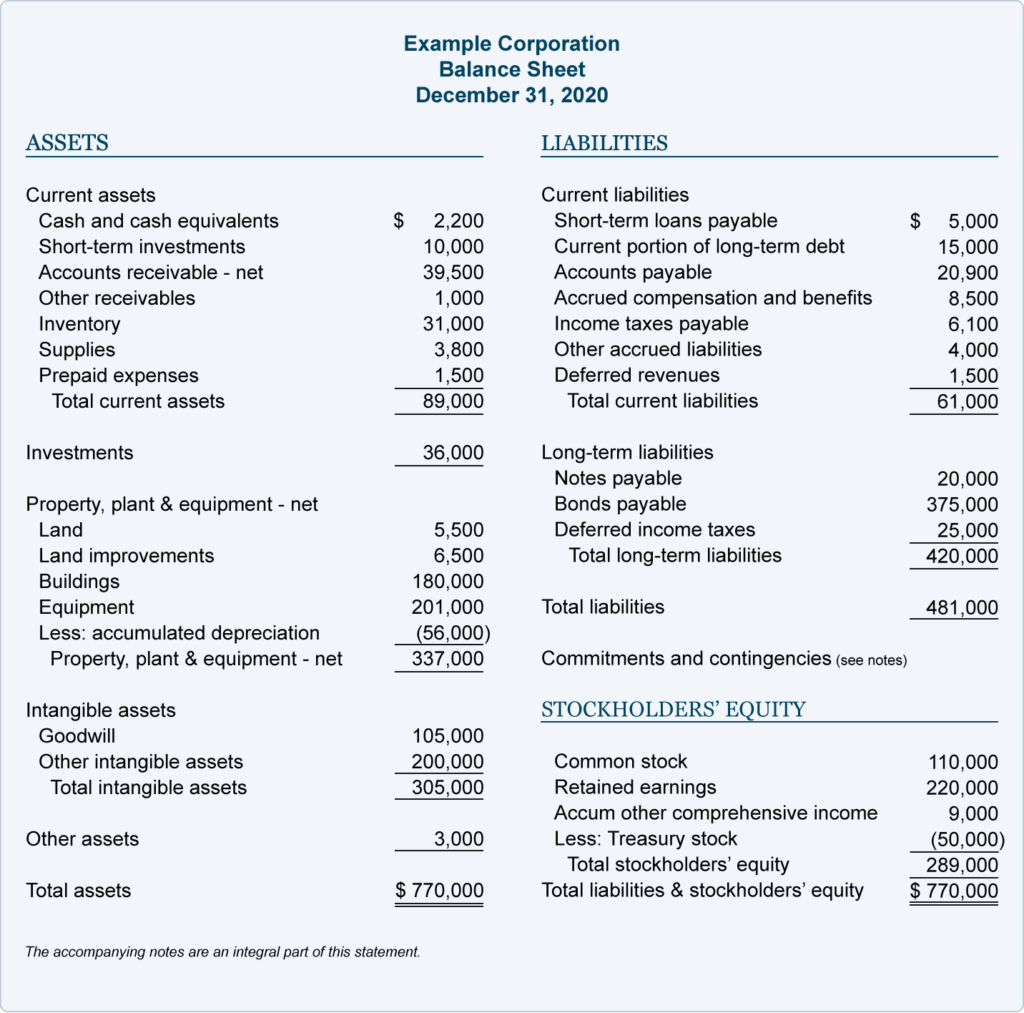

If Companies House requires it, an accountant is the best person to prepare and submit the accounts, as they will know the generally accepted accounting principles. The current ratio is calculated by dividing the total current assets by the total current liabilities. Assets – Fixed Assets, Current Assets, intangible assets, stock, cash, money owed from customers (accounts receivable ledger) and prepayments. If you’ve found that your balance sheet doesn’t balance, there’s likely a problem with some of the accounting data you’ve relied on. You may have omitted or duplicated assets, liabilities, or equity, or miscalculated your totals. As you can see, the report form presents the assets at the top of the balance sheet.

Liabilities Section

You can think of it like a snapshot of what the business looked like on that day in time. There are three main ways to analyze the investment-quality of a company through its balance sheet. First, the convert from xero to qbo has anyone done this fixed asset turnover ratio (FAT) shows how much revenue a company’s total assets generate. Second, the return on assets (ROA) ratio shows how much profit is being generated from its total assets.

Owner’s Equity/ Earnings

Companies settle their liabilities by paying them back in cash or providing an equivalent service to the other party. The term owners’ equity is mostly used in the balance sheet of sole proprietorship and partnership form of business. In a company’s balance sheet, the term owners’ equity is often replaced by the term stockholders’ equity. Most of the information about assets, liabilities, and owners’ equity items is obtained from the adjusted trial balance of the company.

Formatting a Balance Sheet

The composition of the balance sheet is composed of three pieces, which are assets, liabilities, and shareholders’ equity. It should not be surprising that the diversity of activities included among publicly-traded companies is reflected in balance sheet account presentations. In these instances, the investor will have to make allowances and/or defer to the experts. These financial statements are also key for calculating rates of return for your investors and for evaluating the capital structure of your business, both of which are essential processes.

Assets

A balance sheet serves as reference documents for investors and other stakeholders to get an idea of the financial health of an organization. It enables them to compare current assets and liabilities to determine the business’s liquidity, or calculate the rate at which the company generates returns. Comparing two or more balance sheets from different points in time can also show how a business has grown. As described at the start of this article, a balance sheet is prepared to disclose the financial position of the company at a particular point in time. For example, investors and creditors use it to evaluate the capital structure, liquidity, and solvency position of the business.

Then, current and fixed assets are subtotaled and finally totaled together. Everything listed is an item that the company has control over and can use to run the business. Current liabilities are customer prepayments for which your company needs to provide a service, wages, debt payments and more. In both formats, assets are categorized into current and long-term assets.

- The financial statement only captures the financial position of a company on a specific day.

- A balance sheet covers a company’s assets as defined by its liabilities and shareholder equity.

- The applications vary slightly, but all ask for some personal background information.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- Updates to your application and enrollment status will be shown on your account page.

Regardless of the size of a company or industry in which it operates, there are many benefits of reading, analyzing, and understanding its balance sheet. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Activity ratios mainly focus on current accounts to reveal how well the company manages its operating cycle. Financial strength ratios can include the working capital and debt-to-equity ratios.

Learning how to generate them and troubleshoot issues when they don’t balance is an invaluable financial accounting skill that can help you become an indispensable member of your organization. In addition to our balance sheet templates, our business forms also offer templates for the income statement, statement of cash flows, and more. A balance sheet depicts many accounts, categorized under assets and liabilities.

Report the balance of cash and cash equivalence that is to the entity at the reporting date. It could be cash on hand, petty cash, cash deposit in the bank, or other financial note that are equivalent to cash. Shareholders’ equity is calculated by subtracting a company’s liabilities from its assets. This shows how much of the company belongs to its shareholders or owners. As a small business, it’s crucial to maintain a fixed asset register. This register serves as a comprehensive record, detailing all the information about each asset owned by your business.

To put it trivially, the further down you go in the list of uses, the quicker the money is available. For example, positive cash flow is available more quickly than fixed assets such as goodwill, for which you would have to wait to sell it to recover the money. The statement of financial position or (SOFP) is just another name for the balance sheet. When the balance sheet is completed and the starting and ending cash balances that are calculated, the Cash Flow Statement is the next financial statement to tackle. The dividend is the amount that reduces the total shareholders’ equity. It is what the company pays its shareholders and is mostly decided by the board at the end of the year.