If initial investment sizes are very close, we likely will not encounter a size problem. If initial investments are vastly different, we need to be aware of the size problem and use NPV if dealing with mutually exclusive projects. Capital budgeting involves dealing with uncertainty and risk, which can affect the accuracy and reliability of your forecasts and estimates.

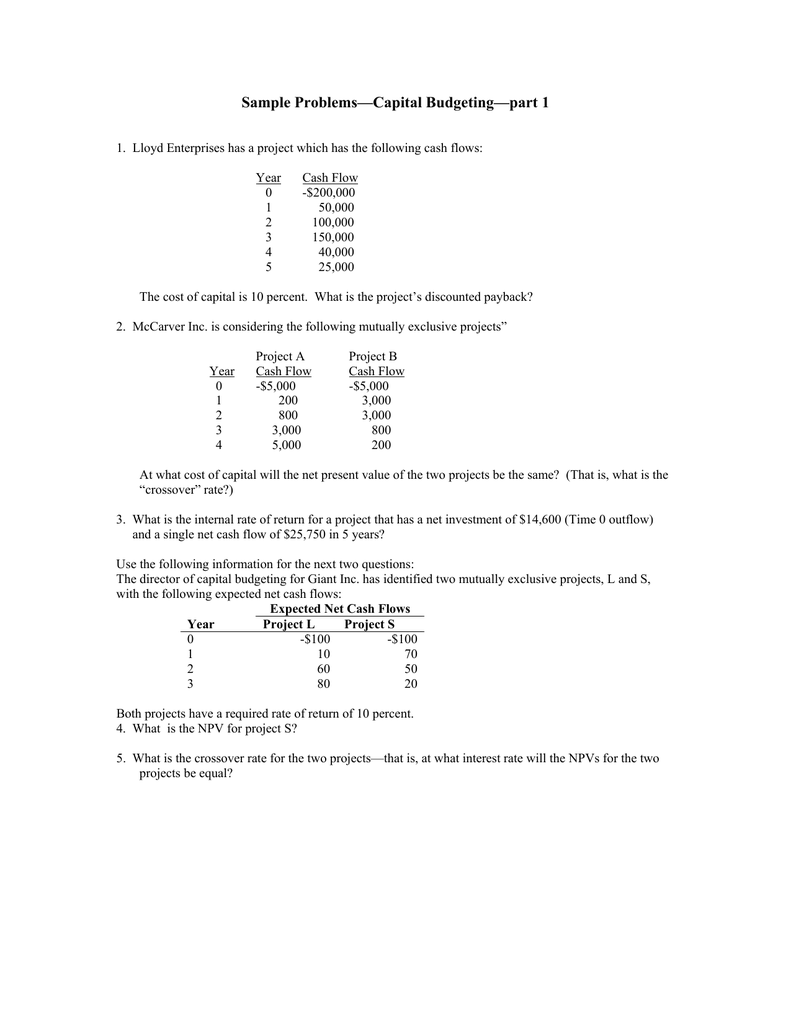

Payback period LO1

- To calculate this, management may consider the difference in the NPV, IRR, or payback periods of two projects.

- Second, there is a process called Modified Internal Rate of Return (MIRR) that can be used to correct this issue.

- Salvage value is the residual value of an investment or asset at the end of its useful life.

- Capital budgeting is important in this process, as it outlines the expectations for a project.

Only area managers have the experience and judgment to fine-tune portfolio selections. Any report that relies on uncontrolled, manually prepared data is typically provided too late or contains out of date data. Due to the effort required to manually collect and present forecasts, for example, there is typically a delay in their preparation and presentation. The longer it takes to get information, the less time we have to take mitigating actions, and the greater the risk of over-spend on failing projects. The capital budgeting numericals are the various types of numbers used in applying different capital budgeting techniques.

Selecting a Project

Corporate governance ensures fair capital investments and stresses risk analysis. This key part of capital budgeting involves identifying pitfalls. However, detailed cash flow forecasts and an appropriate discount rate are needed. Capital budgeting helps companies decide where to invest their money, seek the best returns, ensure that projects align with business goals, and generate strong profits. The process has steps to evaluate investment ideas and choose the best ones.

Mutually Exclusive Projects

To effectively compare the business cases for alternative investment proposals, you should standardize the project evaluation, scoring and ranking methodology. Ensure that any metrics (such as Payback Period) are calculated consistently, and provide a clear and transparent basis for project scoring. Such measures help to expedite and ensure the effectiveness of project prioritization. Examples of capital budgeting include purchasing and installing a new machine tool in an engineering firm, and a proposed investment by the company in a new plant or equipment or increasing its inventories. The standard model costs $72,000 and has a useful life of 6 years.

Why Is Capital Budgeting Important For Businesses?

The VIP Express discount factor is 0.386 taken from row 10, 10% column. Column B lists the cash inflows and outflows for the project or investment. The IRR for the Diamond LX model is 2% higher than the VIP Express model. As demonstrated in the preceding section, the simple rate of return for the Diamond LX model is 1.1% higher than the VIP Express model. The IRR is more accurate than the simple rate of return because it considers the time value of money as well as the useful life of the projects. The discount factors provided in the tables cover two types of present value calculations, lump sum and annuity.

All in all, the follow-up system for all the invoices can be passed on to the system of Deskera Books and it will look into it for you. You can have access to Deskera’s ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant. Such cloud systems substantially improve cash flow for your business directly as well as indirectly.

Senior managers review all the data and decide whether to proceed. They consider the project’s value, fit with business goals, and potential challenges. Once they approve, the project receives funding, and planning begins.

In any project decision, there is an opportunity cost, meaning the return that the company would have received had it pursued a different project instead. In other words, the cash inflows or revenue from the project need to be enough to account for the costs, both initial and ongoing, but also to exceed any opportunity costs. Simple project portfolio management can be conducted within your capital budgeting process. It’s typically only these resource intensive capital projects that are included in the project portfolio management system, whilst all capital purchases require budgeting and approval.

It involves forecasting future cash flows and analyzing profitability, while regular budgeting typically manages routine expenses and revenues within shorter fiscal periods. Capital Budgeting is a critical financial process that involves evaluating and selecting long-term investments that are worth more than their cost. This method prioritizes projects based on their potential to increase a company’s value, focusing on cash flows, timing, and risk analysis.

Net cash inflows for the Diamond LX and VIP Express are $126,000 ($73,000 + 53,000) and $148,680 ($76,980 + 71,700), respectively. Managers are responsible for many decisions, some with short-term and others with long-term financial consequences. Projects and investments with long-term financial consequences are referred to as capital projects. Therefore, capital budgeting refers to the process what’s the recovery rebate credit of planning projects or making decisions that have a long-term effect on the organization. Examples of capital projects include investments in long-term assets such as vehicles, machines, facilities, or equipment; launching new products or services; and expanding operations. The profitability index (PI) is calculated by dividing the present value of future cash flows by the initial investment.